Ethical investing opens the door to a world where financial decisions aren’t just about profit, but also about making a positive impact. Dive into the realm of ethical investing, where values meet investment strategies in a unique blend of purpose and profit. Get ready to explore the landscape of finance through a new lens, one that prioritizes sustainability, social responsibility, and personal values.

As we delve deeper into the realm of ethical investing, we uncover a treasure trove of opportunities and challenges that shape the way we invest our money for a better tomorrow.

Definition of Ethical Investing

Ethical investing, also known as socially responsible investing (SRI), is an investment approach that considers both financial return and ethical or societal values. It involves selecting companies or funds that align with the investor’s ethical beliefs or values, such as environmental sustainability, social justice, or corporate governance.

Examples of Ethical Investment Strategies

- Impact Investing: Investing in companies or projects that aim to generate a positive social or environmental impact alongside financial returns.

- Divestment: Avoiding investments in companies involved in controversial industries such as tobacco, weapons, or fossil fuels.

- ESG Integration: Incorporating environmental, social, and governance (ESG) factors into the investment decision-making process to assess the sustainability and ethical practices of companies.

The Importance of Ethical Investing in Today’s Financial Landscape

Ethical investing is gaining popularity as investors seek to support companies that align with their values and beliefs. In today’s financial landscape, where environmental and social issues are becoming increasingly important, ethical investing can drive positive change and encourage companies to adopt sustainable practices. By investing ethically, individuals can contribute to a more sustainable and responsible economy while potentially earning competitive financial returns.

Principles of Ethical Investing

Ethical investing is guided by key principles that help investors make decisions that align with their values while seeking financial returns. By understanding these principles, individuals can make informed choices that reflect their personal beliefs and goals.

Ethical Investment Criteria

- Environmental Sustainability: Investing in companies that prioritize eco-friendly practices and reduce their environmental impact.

- Social Responsibility: Supporting businesses that uphold fair labor practices, diversity, and community engagement.

- Corporate Governance: Choosing companies with transparent and ethical leadership, accountable management practices, and strong integrity.

- Positive Impact: Investing in organizations that contribute to societal well-being, such as healthcare, education, or renewable energy.

Comparison with Traditional Investing

- Traditional investing focuses solely on financial returns, often overlooking the broader impact of companies on society and the environment.

- Ethical investing considers both financial performance and ethical considerations, providing a more holistic approach to investment decisions.

- While traditional investing may prioritize short-term profits, ethical investing looks at long-term sustainability and positive outcomes for all stakeholders.

Alignment with Personal Values and Financial Goals

- Ethical investing allows individuals to support causes they believe in while potentially earning competitive returns on their investments.

- By aligning investments with personal values, investors can feel a sense of fulfillment and contribute to positive change in the world.

- Choosing ethical investments that align with financial goals can help individuals build a diversified portfolio that reflects their beliefs and aspirations.

Types of Ethical Investment Opportunities

When it comes to ethical investing, there are various types of investment opportunities that align with different values and goals. These opportunities allow investors to make a positive impact while also seeking financial returns.

Socially Responsible Investing

Socially responsible investing (SRI) involves selecting investments based on ethical, social, and environmental criteria. Companies that prioritize sustainability, diversity, and corporate governance are often favored in SRI portfolios. For example, investing in companies that promote clean energy, support fair labor practices, or have strong community engagement can be considered socially responsible.

Impact Investing

Impact investing focuses on generating measurable social or environmental impact alongside financial returns. This type of investment targets specific issues such as poverty alleviation, healthcare access, or climate change. Impact investors aim to create positive change through their investment decisions, supporting organizations that actively work towards solving global challenges.

Examples of Ethical Investments

– Companies in the renewable energy sector, such as solar or wind power companies, are commonly associated with ethical investing due to their contribution to reducing carbon emissions.

– Fair trade companies that ensure fair wages and working conditions for employees are also popular choices for ethical investors.

– Technology companies that prioritize data privacy and cybersecurity can be considered ethical investments as they uphold consumer rights and protection.

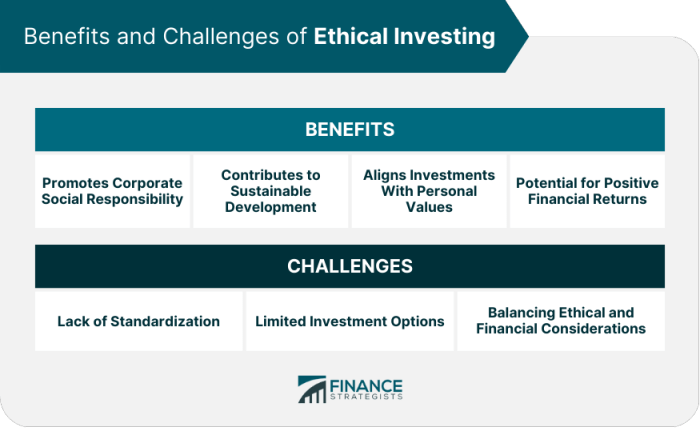

Potential Risks and Benefits

Investing in ethical funds or companies can offer various benefits, including the satisfaction of knowing your money is supporting causes you believe in, potential for long-term growth in industries focused on sustainability, and alignment with personal values. However, there are also risks to consider, such as the possibility of lower returns compared to traditional investments, limited diversification in certain sectors, and the challenge of measuring social impact alongside financial performance.

Impact and Performance of Ethical Investments

When it comes to ethical investing, the impact on society and the environment is significant. By choosing to invest in companies that prioritize sustainability, social responsibility, and ethical practices, investors can contribute to positive change in the world.

Impact on Society and the Environment

- Companies that focus on ethical practices often engage in fair labor practices, support diversity and inclusion, and give back to their communities.

- Investing in environmentally conscious businesses can lead to reduced carbon footprints, cleaner energy solutions, and overall better environmental stewardship.

- Ethical investing can encourage other companies to follow suit, creating a ripple effect of positive change across industries.

Performance Comparison with Conventional Investments

- Studies have shown that ethical investments can perform just as well, if not better, than conventional investment options.

- Companies with strong ethical practices are often more resilient to economic downturns and crises, leading to more stable returns for investors.

- Long-term performance of ethical investments may outshine conventional investments as sustainability becomes increasingly important in the global economy.

Success Stories in Ethical Investing

- One notable success story is Patagonia, an outdoor clothing company known for its commitment to environmental sustainability and social responsibility.

- Another example is Unilever, a multinational consumer goods company that has made significant strides in reducing its environmental impact and promoting ethical sourcing.

- These companies not only excel in ethical practices but also demonstrate that profitability and sustainability can go hand in hand.